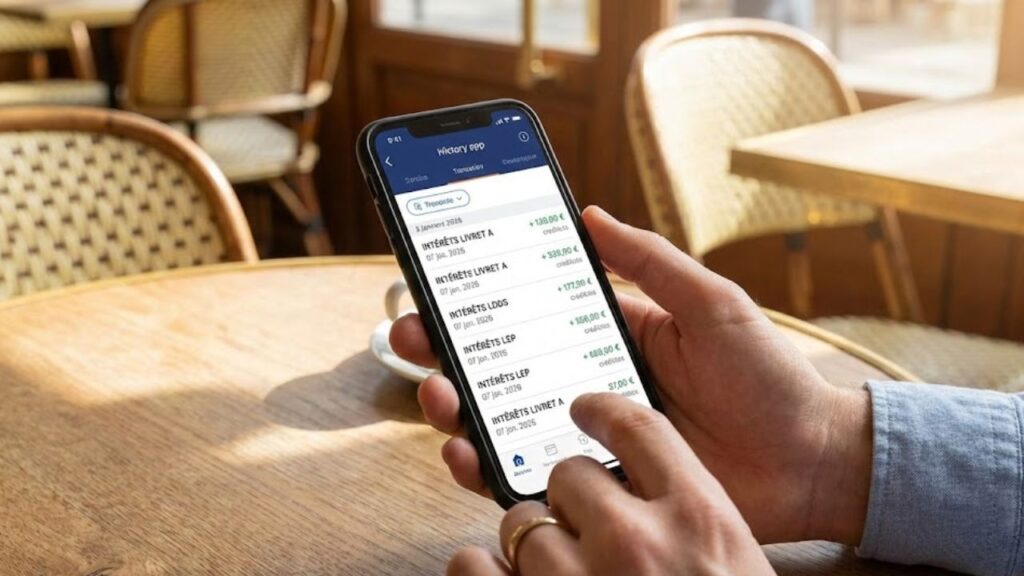

All across France, millions of savers are repeatedly opening their banking apps, waiting for the annual interest credit on their regulated savings accounts. Those few days around the New Year often feel significant, even though the interest was technically accumulated throughout 2026.

How interest on regulated savings is calculated for 2026

For the 2026 interest year, calculations stop on 3 February 2026. This cut-off date determines the exact interest amount earned over the year.

The interest visible in early 2026 therefore reflects savings held and calculated up to3 February 2025.

Once calculations are completed, each bank chooses when to post the interest to Livret A, LEP, or LDDS accounts. Although the interest belongs to the year just ended, it only becomes visible on balances during the first days of January 2026.

Main payment window: 31 December 2025 to 3 February 2026

Most French banks follow a similar timeline, though not all credit interest on the same day. For 2026, regulated savings interest is paid within a short window running from 31 December 2025 to 6 January 2026.

This small difference can still matter. Savers often wonder whether the interest can be used immediately or whether early-January transfers will include the new amount. For households relying on these accounts as a short-term buffer, timing can be crucial.

In practice, regulated savings interest for 2026 appears between 31 December 2025 and 6 January 2026, depending on the bank.

Banks crediting interest from 31 December 2025

Some major banking groups are among the earliest to credit interest. They begin posting interest from 31 December, even though the calculation period officially ends that day. For 2026, this applies in particular to:

If your Livret A, LEP, or LDDS is held with one of these institutions, you may already see your 2025 interest reflected in your balance on New Year’s Eve. This can be useful when finalising your year-end budget.

Interest credited on 1 February 2026

A second group of banks credits interest at the very start of the new year. With these providers, interest typically appears on 1 February 2026:

In reality, some customers only notice the credit on 2 January due to overnight processing. Internally, however, the value date is generally set as 1 January.

Banks paying interest on 2 February 2026

BNP Paribas and Boursorama Banque have chosen to credit interest at the start of the first working days of the year. Customers with these banks should see their annual interest posted on 2 January 2026.

This represents a short delay after the New Year, even though the calculation still uses the same 31 December reference date.

Later payments: up to 6 January 2026

A small number of banks fall at the end of the schedule, with interest credited during the first full week of January. For 2026, LCL and Société Générale plan to credit interest between 5 and 6 January.

Customers of LCL and Société Générale should therefore expect their 2025 interest to appear between 5 and 6 January 2026.

While still within the national norm, this delay can matter if the funds are needed for early-month expenses. Checking account history before scheduling large payments can help avoid surprises.

Summary of 2026 interest credit dates by bank

Crédit Agricole, Crédit Mutuel, CIC: from 31 December 2025

Caisse d’Épargne, Banque Populaire, La Banque Postale, Fortuneo: 1 January 2026

BNP Paribas, Boursorama Banque: 2 January 2026

LCL, Société Générale: 5–6 January 2026

Home-savings plans and life insurance timelines

PEL and CEL: early-January credits

PEL (Plan d’épargne logement) and CEL (Compte d’épargne logement) follow a similar logic to regulated savings accounts. Interest is calculated up to the end of the year and credited during the first days of January.

Although banks are not required to credit PEL and CEL interest on the exact same day as Livret A interest, many customers see these amounts appear around the same period.

Life insurance: a slower process

Life insurance contracts, especially euro-denominated funds, operate on a different timetable. Insurers must first finalise annual yields before applying them to individual contracts.

As a result, life insurance interest is typically credited around mid-January, and sometimes later depending on the provider. Detailed statements may only appear toward the end of January, even though returns start accruing from 1 January.

Why these dates matter for daily finances

Knowing when interest will be credited can make short-term money management easier. Many households rely on their Livret A or LDDS to cover rent, utilities, or lingering December expenses.

If interest is credited on 31 December, it can help support early-January direct debits. When payment arrives closer to 5 or 6 January, it may come too late for some standing orders, making advance planning essential.

- Check your bank’s expected credit date.

- Confirm the credited amount once it appears.

- Adjust transfers after the updated balance is visible.

Example scenario with multiple regulated accounts

Imagine a saver holding a Livret A (€15,000), a LEP (€5,000), and an LDDS (€3,000) at the same bank. Each account earns interest at its regulated rate during 2025, with calculations finalised on 31 December.

If the bank credits interest on 1 January 2026, the saver may see several hundred euros added overnight. They can then decide whether to keep the funds invested or transfer part of the interest to cover January expenses.

For those on tighter budgets, this annual credit can feel like a small “13th month”, even though it simply reflects savings patiently held throughout the year.

Key terms for non-French readers

- Livret A: a tax-free, capped savings account with a state-set rate.

- LEP: a higher-rate account reserved for lower-income households.

- LDDS: similar to Livret A, with a focus on sustainable projects.

- PEL / CEL: housing savings products designed to support future property purchases.

All these products share the same rhythm: interest earned over the year, then credited once as the new year begins. For 2026, the exact day may vary slightly, but the principle remains unchanged—the savings set aside during 2025 quietly appear on statements in early January.