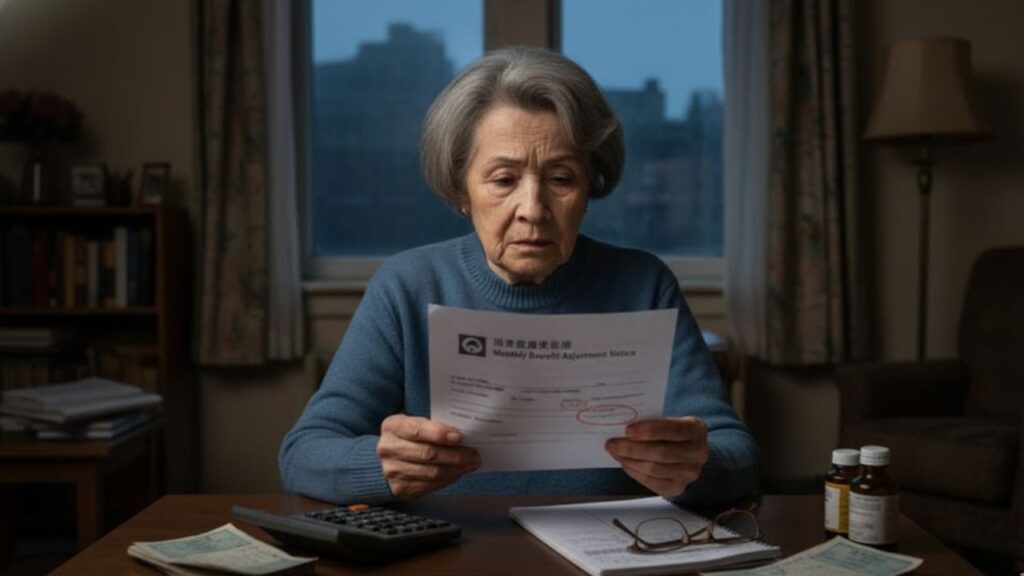

The envelopes began appearing on doorsteps just after the New Year. Plain, white, and unremarkable — the kind most people expect to hold routine paperwork. This time, though, the message inside made hearts pause. The notice stated clearly that state pension payments would drop by $140 per month starting February. For many older Americans, that single line carried weight far beyond numbers. It marked a sudden shift in what retirement would look like, turning everyday expenses into difficult choices and forcing people to confront a reality they never planned for.

The Human Cost Behind a $140 Monthly Reduction

On paper, $140 can seem minor, a small correction buried in budget reports. In real life, it’s the difference between filling a grocery cart or leaving items behind, between warmth and another sweater indoors. Retirees across the country are recalculating expenses at kitchen tables, staring at bank balances that no longer stretch as far. Rent, medication, and food costs haven’t eased. With the cut beginning in February — a time when winter expenses peak — the impact lands immediately, not as theory but as a lived experience.

When Fixed Incomes Meet Rising Costs

For couples like Frank and Lila, both 68 and living modestly outside Phoenix, the numbers are stark. Their combined state pension of $1,350 per month was designed to cover essentials, with small extras left for emergencies or simple pleasures. From February, that drops to $1,210. The $140 once reserved for medication co-pays, an occasional meal out, or a small savings buffer is gone. That loss forces routine changes, not luxuries — a pattern repeated across hundreds of thousands of households.

Why Governments Call It “Recalibration”

Officials describe the reduction as a necessary adjustment, framed with phrases like long-term sustainability and fiscal responsibility. The reasoning follows a familiar formula: more retirees, fewer contributors, and rising healthcare costs. On spreadsheets, trimming a fixed amount from each pension appears manageable. But when those figures translate into real gaps in monthly budgets, trust in the system weakens. What seems efficient on paper can feel deeply personal at the kitchen table.

Why storing rosemary and coarse salt in the same indoor jar divides cooks who is really right

Why storing rosemary and coarse salt in the same indoor jar divides cooks who is really right

Practical Ways Retirees Are Responding Now

Many are starting with the basics: reworking monthly budgets line by line. Fixed costs like housing, utilities, insurance, and essential medication come first. Variable spending — groceries, transport, small comforts — is examined next. By identifying non-negotiables and questioning every other expense, retirees can spot shortfalls early. It’s uncomfortable, but seeing the numbers clearly before accounts dip into the red restores a sense of control.

Why Talking Early Can Make a Difference

Another crucial step is conversation. Speaking with family, landlords, or service providers can feel difficult, especially after a lifetime of independence. Yet these discussions often open doors. Hardship plans, payment flexibility, and overlooked discounts exist, but they’re rarely offered unless asked for. Staying silent usually costs more in the long run, both financially and emotionally.

Small Adjustments That Add Up

Community financial counselors consistently see certain strategies help soften the blow. These aren’t dramatic fixes, but small wins that matter more when income is fixed. Reviewing medications for generic options, negotiating phone or internet plans, checking eligibility for every available benefit, and sharing bulk grocery purchases are all common examples. Local senior centers also provide access to free legal and financial guidance that many overlook.

- Switching to generic medications after professional review

- Requesting loyalty discounts from service providers

- Rechecking eligibility for benefits and tax credits

- Sharing bulk food purchases to reduce costs

- Using senior centers for free advisory services

What the Cut Reveals About Aging and Security

A reduction in state pensions is more than a financial update. It touches on long-held promises about retirement security. Many believed that years of work and contributions guaranteed a stable foundation later in life. With February’s change, that foundation feels thinner. Some retirees are quietly returning to work, delaying medical care, or leaning on family support — sacrifices that never appear in official reports.

The Broader Impact on Trust and Planning

The psychological effect is just as real. People who once felt settled now speak of re-entering the workforce in their seventies, not by choice but necessity. For younger generations watching, the message is clear: the pension system no longer feels fixed. While it still exists, it now appears more uncertain, making early planning, diversified income, and understanding benefits feel essential rather than optional.

Where the Conversation Goes_toggle Next

The debate risks becoming polarized, while those already affected quietly absorb the impact. Yet there’s room for constructive responses: community support, better outreach, and open family conversations about money without shame. Policymakers argue the cut protects future stability. Retirees question why that protection consistently arrives as present-day hardship. What’s certain is that February’s payments will arrive lighter, and each household will decide what to give up, what to preserve, and who to rely on.

Key Takeaways at a Glance

- $140 monthly pension reduction begins in February, directly affecting fixed incomes

- Immediate adjustments include budgeting, renegotiating bills, and reviewing benefits

- Long-term implications involve reduced trust and greater emphasis on personal planning