Families handling a death usually focus on bank balances and property values. Yet one often-overlooked factor – the contents of the home – can quietly push the inheritance tax bill much higher. In France, a simple inventory of furniture and personal belongings can lead to significant tax savings. Many heirs, however, remain unaware that this option even exists, and end up paying tax on values that do not reflect reality.

How French inheritance rules quietly increase estate value

When a person dies in France, the estate includes more than just the house, apartment, or savings. The tax authorities also attribute a value to everything inside the property – furniture, crockery, rugs, artwork, wardrobes, and everyday household items. If no valuation is provided, the administration applies a default calculation that can substantially increase the taxable estate.

The forfait mobilier explained

By default, French tax law applies the forfait mobilier, a flat-rate estimate of household contents. This rate is fixed at 5% of the gross real-estate value. Without a specific inventory, the tax office automatically adds this percentage to the estate, regardless of what the property actually contains.

This approach is efficient for administration, but it can be misleading for families. A modest flat furnished with basic, worn items is treated proportionally the same as a luxury home filled with high-end pieces. Depending on the situation, this rule can either benefit heirs or cause them to overpay.

At odds with the family, one heir refuses to see the notary: can the estate still be settled?

At odds with the family, one heir refuses to see the notary: can the estate still be settled?

Why a professional inventory can reduce inheritance tax

Financial advisers in France increasingly recommend one practical step: commissioning a formal inventory of household contents. This replaces the flat 5% assumption with a valuation based on real market prices, supported by official documentation.

For example, a property valued at €250,000 automatically attracts a presumed furniture value of €12,500 under the standard rule. In reality, the contents of an older or modestly furnished home may be worth far less. An inventory can reflect this, ensuring heirs are taxed only on what actually exists.

If the documented value drops from €12,500 to €3,000, the taxable estate is reduced accordingly. Depending on family relationships and tax bands, that difference can translate into thousands of euros saved.

Who benefits from the flat-rate – and who doesn’t

The 5% rule is not always unfavourable. In some cases, it can work to an heir’s advantage, particularly when a home contains antiques, designer furniture, art, or valuable collections. In those situations, the real value of the contents may exceed the flat-rate estimate.

- High-end, well-furnished homes: the flat-rate may be favourable.

- Modest or sparsely furnished properties: an inventory often lowers tax.

- Mixed contents: inventories help separate valuable items from everyday ones.

Arranging an inheritance inventory in France

The process typically starts with the notaire managing the succession. If qualified, the notaire may carry out the inventory themselves. Otherwise, they will appoint a commissaire de justice to perform the valuation.

Although professional fees apply, they are often modest compared with the potential tax savings. A few hundred euros spent on an inventory can easily be offset if it significantly reduces the declared value of household contents.

| Option | Who does it? | Typical cost | When it makes sense |

|---|---|---|---|

| Inventory by the notaire | Notaire with valuation skills visits the property | Around €600 | For most standard estates where contents are modest |

| Inventory by a commissaire de justice (bailiff) | Judicial officer plus, if needed, an expert appraiser | €600 + expert and travel fees | For complex estates, distant properties, or when high-value items are suspected |

What the inventory process involves

The inventory is methodical and structured. The professional visits the property and records items room by room. Objects are grouped where appropriate and assigned realistic resale values based on current market conditions.

Wrapping A “Jacket” Around Your Hot Water Tank Could Save £50–£60 On Your Energy Bill This Winter

Wrapping A “Jacket” Around Your Hot Water Tank Could Save £50–£60 On Your Energy Bill This Winter

Items with little resale value – worn furniture, outdated electronics, chipped crockery – are valued accordingly. In contrast, pieces such as designer furniture, authenticated artwork, or collectible jewellery are assessed more carefully. The final document becomes part of the official inheritance file and replaces the default 5% rule.

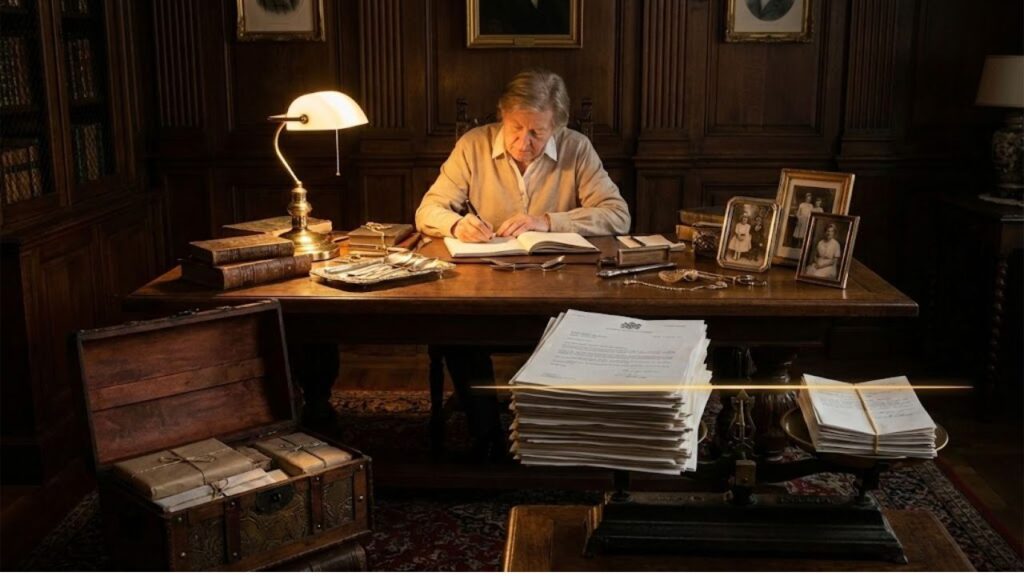

Emotional and practical challenges for families

Sorting through personal belongings can be emotionally difficult, especially during mourning. Assigning monetary values to sentimental objects may feel uncomfortable. However, treating the inventory as a protective financial step can ease long-term stress.

A clear valuation reduces the risk of disputes between heirs and helps avoid unpleasant surprises when tax bills arrive. It also simplifies decisions about what to keep, sell, or donate.

When commissioning an inventory makes the most sense

Certain situations strongly suggest that a professional inventory is worthwhile. These include cases where the property value is high but furnishings are modest, where heirs anticipate disagreements, or where the estate sits close to a tax threshold.

Conversely, if a home clearly contains valuable antiques or art, heirs should consider whether an inventory might increase the declared value. In such cases, some families choose to accept the flat-rate as a practical ceiling.

Key terms heirs should know

Understanding a few legal concepts can help families navigate French inheritance rules more confidently:

- Forfait mobilier: the 5% flat-rate used when no inventory is provided.

- Actif immobilier brut: the gross real-estate value before debts.

- Notaire: the public legal officer handling successions.

- Commissaire de justice: the official authorised to produce inventories.

Implications for British and international families

Foreign families inheriting property in France are also subject to these rules. Whether it is a holiday home, city apartment, or rural house, French inheritance tax applies to assets located in France, including household contents.

In many cases, properties owned by non-residents contain basic, second-hand furniture. Without an inventory, heirs may face a surprisingly high tax bill based on a purely theoretical valuation. By requesting an inventory through the notaire, families can ensure the declared value reflects reality.

For those planning ahead, including instructions for an inventory in estate documents can provide valuable guidance to heirs. This small administrative step can make a substantial difference at a time when clarity and simplicity matter most.