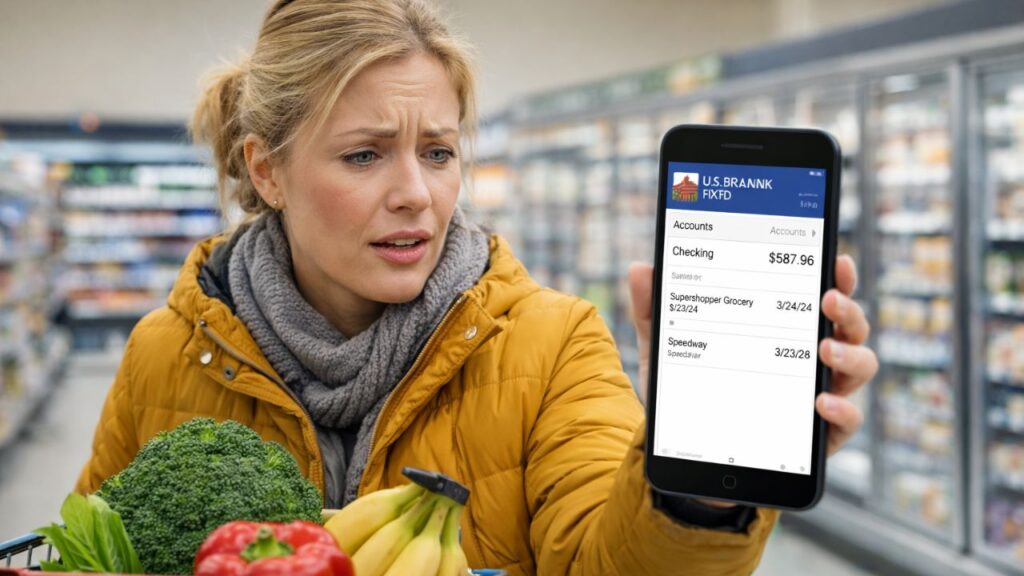

The notification buzzed Megan’s phone just as she tapped her card at the grocery store. Standing at the self-checkout, she was already bracing herself to remove an item or two. Rent had increased, her student loan payments had resumed, and her last tax refund felt like something from a different era. Almost automatically, she opened her banking app. Then she stopped cold.

A new entry sat there: “U.S. Treasury deposit – $2,000.” No letter had arrived. No warning had shown up beforehand. Just money that instantly reshaped her entire day. Her first reaction wasn’t celebration. It was a quiet, cautious thought: “Is this legitimate… and can I actually keep it?”

That moment is exactly what many Americans are quietly hoping to experience this February.

$2,000 Direct Deposits in February: Separating Hype From Reality

Spend a few minutes scrolling TikTok or YouTube Shorts and the same promise keeps appearing: “$2,000 payments in February!” Thumbnails shout “Act fast” and “New stimulus”, often paired with grainy bank screenshots and official-looking logos. Comment sections fill with people asking whether anyone has truly received the money and how it happened. The mood swings between excitement and uncertainty.

Behind the noise, however, something more grounded is unfolding. A combination of tax refunds, benefit adjustments, and targeted relief payments is scheduled to reach U.S. bank accounts this month. Some individuals will genuinely see $2,000 or more arrive at once. Others will see nothing at all and wonder if they missed out on something hidden.

Consider Brian, a warehouse employee in Ohio. He submitted his 2024 tax return on the very first day e-filing opened. Between the Earned Income Tax Credit for his two children, the Child Tax Credit, and slightly over-withholding from his paychecks, his refund came to just over $2,050. For him, the widely shared “$2,000 direct deposit” isn’t a mystery program. It’s simply the tax system balancing out a year of work.

Then there’s Linda, a 69-year-old retiree relying on Social Security and a small pension. She’s seen posts about “extra $2,000 checks” in her online groups. After looking closer, she realizes her February increase is coming from a tax refund combined with a modest Social Security payment adjustment linked to last year’s cost-of-living increase. No flashy announcement explained it. She just noticed the numbers change and wanted clarity.

So why does the phrase “$2,000 direct deposit” keep circulating this February? Several things are overlapping at once. The IRS is actively processing early tax returns, and many low- and moderate-income workers with children routinely receive refunds near or above $2,000 because of refundable credits. Some states are also issuing remaining rebates or relief payments this month, adding to federal deposits. On top of that, the internet blends solid facts with hopeful speculation until the distinction fades.

The straightforward truth is this: there is no new universal $2,000 federal stimulus. Still, there are legitimate situations where $2,000 does appear in February for certain individuals.

Goodbye Hair Dye for Grey Hair: The Conditioner Add-In That Gradually Restores Natural Colour

Goodbye Hair Dye for Grey Hair: The Conditioner Add-In That Gradually Restores Natural Colour

Who May Receive the Money, What the IRS Says, and When It Arrives

The clearest way to understand February deposits is to focus on official IRS guidance, not social media claims. For U.S. citizens who worked during 2024, the most realistic path to a $2,000 direct deposit is through a tax refund. That amount typically increases when three factors align: taxes were withheld, the filer qualifies for credits such as the Earned Income Tax Credit or Child Tax Credit, and the return is filed electronically with direct deposit selected.

For retirees and benefit recipients, February increases usually come from a mix of tax refunds and routine benefit adjustments, not from any newly approved stimulus program.

This is where confusion often starts. Headlines about “$2,000 checks for Americans” can sound automatic, as if everyone qualifies without action. As a result, some people delay filing until later in the spring or overlook information that could make them eligible for credits aimed at low-income workers or parents. The individuals seeing $2,000 or more in February are often not wealthier or luckier. They simply filed early, reported income accurately, and followed standard IRS instructions that rarely go viral.

- Eligibility focus: U.S. citizens with earned income, qualifying children, or low-to-moderate wages are the most likely to receive refunds of $2,000 or more.

- Payment timing: Most e-filed returns with direct deposit are processed within about 21 days, though returns involving certain credits may take longer.

- IRS tracking: The official “Where’s My Refund?” tool remains the most reliable way to check payment status.

- Warning signs: Claims of “instant $2,000 approval” or so-called bonus checks that require fees or login details are commonly linked to scams.

Viral headlines rarely tell the full story; accurate information still comes from IRS.gov and your own tax records.

The Impact of a February Deposit and the Decisions That Follow

Imagine opening your banking app on a dull February afternoon and spotting an extra $2,000 sitting there. The first reaction might be relief, followed by thoughts of unpaid bills, lingering credit card balances, or a car repair that can’t be postponed any longer. The deposit may not solve everything, but it changes the tone of the month.

Whether that money comes from a tax refund, a state rebate, or a benefit adjustment, it appears as one clear number on your screen. What happens after that moment is where its real value takes shape.

| Key point | Detail | Value for the reader |

|---|---|---|

| Refunds can hit $2,000+ | Credits like EITC and Child Tax Credit often push refunds above $2,000 for eligible workers and parents | Helps you see if you realistically fall into the “$2,000 direct deposit” group |

| Timing is everything | E‑filed returns with direct deposit can pay out in about 3 weeks, sometimes landing in February for early filers | Lets you plan bills, debt payments, or urgent purchases around a probable window |

| Trust IRS tools, not rumors | “Where’s My Refund?” and official IRS alerts beat viral posts for accuracy | Reduces anxiety, avoids scams, and gives you a clear picture of what’s coming |